1. What is a managed fund?

Managed funds are an easy way for investors to gain access to a professionally managed portfolio of both local and global stocks.

2. Why invest in a managed fund?

- Provides access to a broad range of investments you otherwise may not have access to by pooling your money with other investors

- These investments can be diversified across countries, asset classes (e.g. shares, property, bonds, cash), industries and companies leading to diversification of your investment and thus reducing the impact of fluctuations in an investment’s market value.

- You don't need to do the heavy lifting as the fund is managed for you by the experts.

3. Kristal's early stage fund

3.1 What is Kristal's early stage fund?

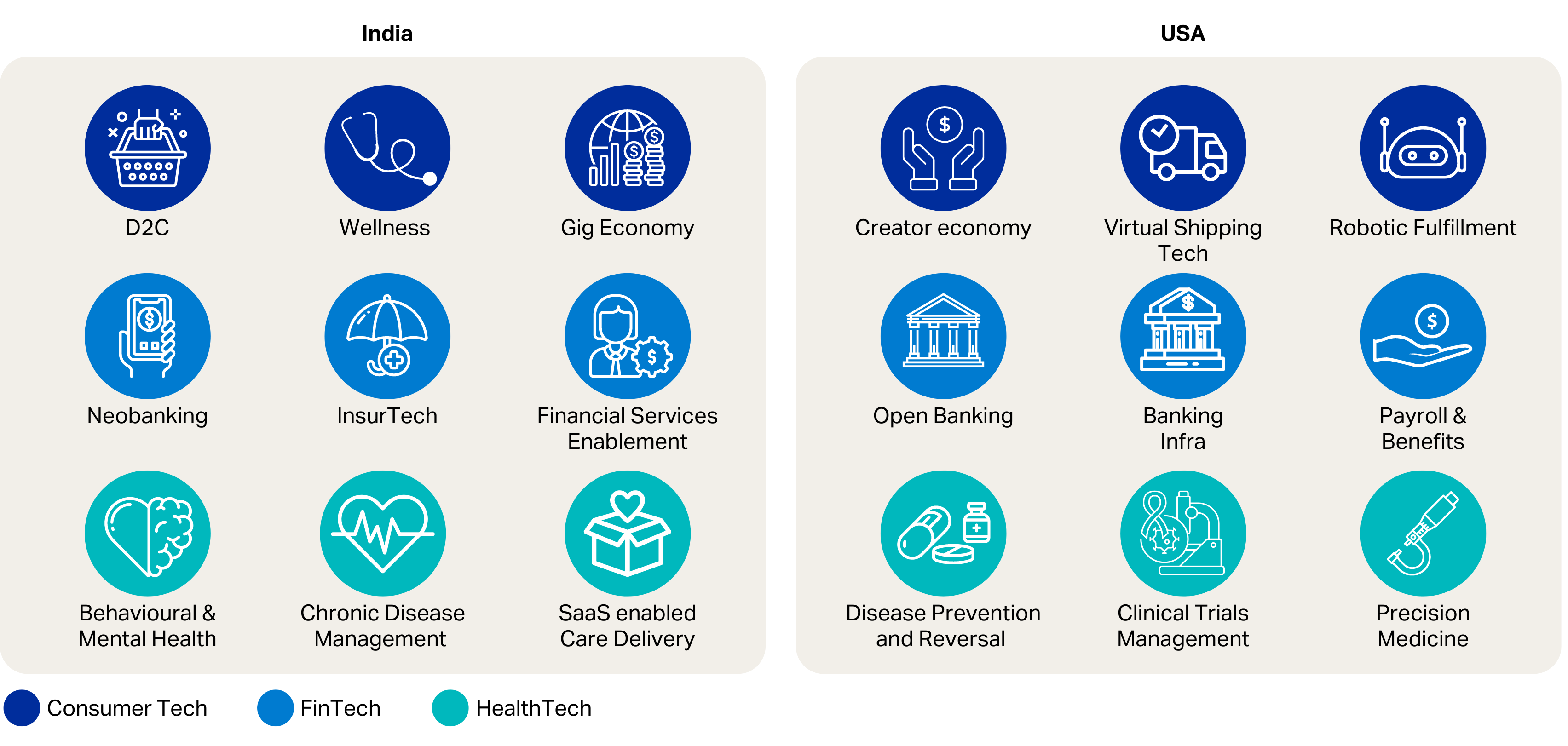

Kristal's early stage fund is a fund focused on investing in high-conviction ideas from Seed to Pre-Series A companies with strong fundamentals across three sectors namely ConsumerTech, FinTech, and HealthTech.

The investments will follow key trends across Digital Natives, Future Tech Building Blocks, and The Great Reset primarily in India and the US.

It will be managed by an executive team consisting of members in the Investment Committee, External Panel/ Investors, Consultants, and our Kristal Private Markets team of 10+ professionals.

The investment process follows robust screening and due diligence starting from the preliminary screening, to demo days which require founders to make pitches to the External Panel/ Investors and finally a review and selection of the company.

Themes:

Digital Natives: Demographics of 500M+ more comfortable consuming goods and services online.

Future Tech Building Blocks: IoT, AI, and VR-enabled services will make the internet pervasive and seamless

The Great Reset: Covid has accelerated the adoption of digital tools and altered attitudes toward well-being.

Intrigued to know more about Kristal's early stage fund? Click below:

4. Pre-IPO Fund

4.1 What is Kristal's Pre-IPO Fund?

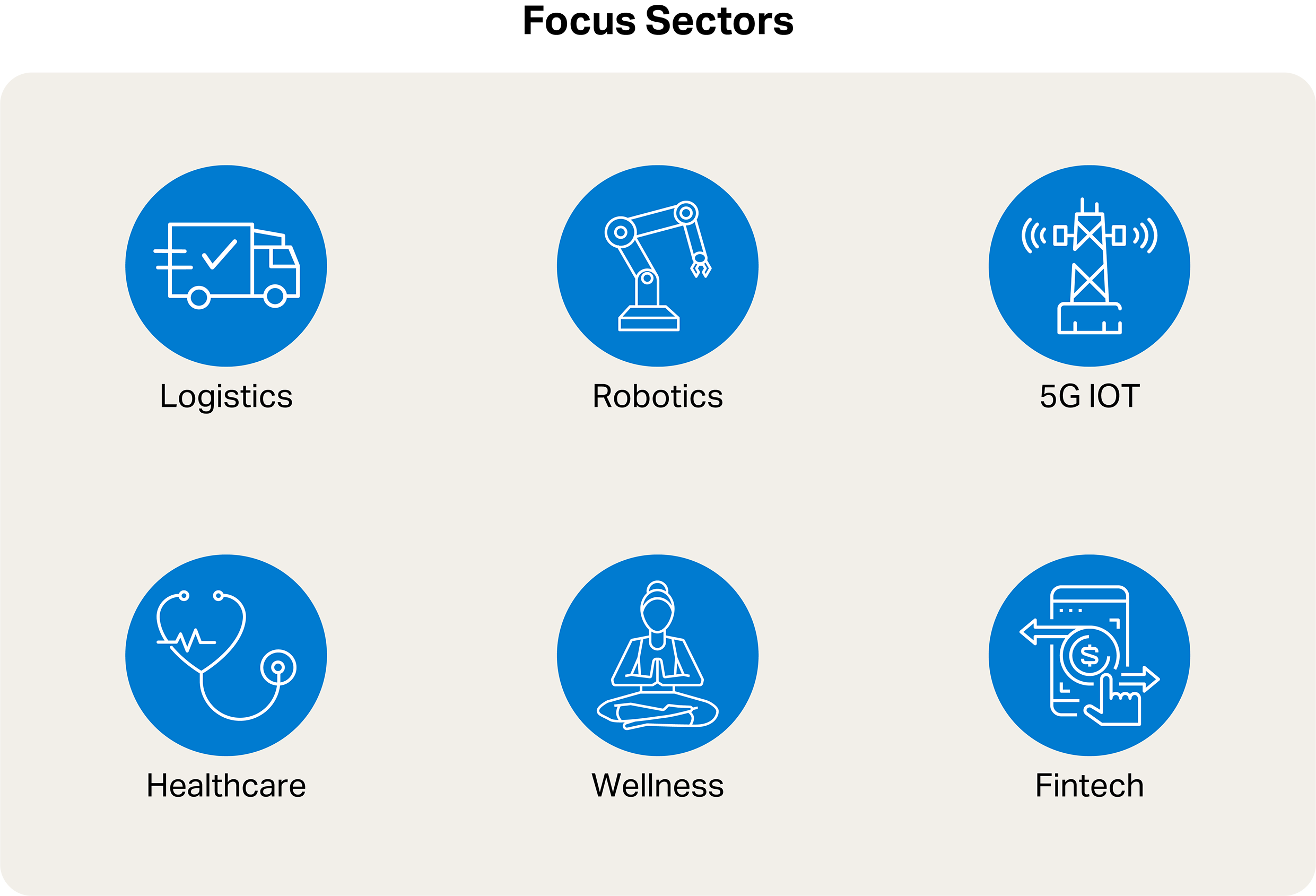

Kristal's Pre-IPO Fund is focused on investing in growth to late/pre-IPO stage companies across three themes namely Tech Diffusion, Covid Rewiring, and Sustainable Living in high potential industries with significant global growth rates. This will be done through primary and secondary transactions in a secured manner at competitive valuations; leading to wealth maximization.

The fund will have a maximum fund size of $50M and is expected to have a lifespan of 5 years which may be extended by 2 consecutive years in the scenario that any investment(s) has not been exited by year 5. It will be managed by an executive team consisting of two members in the Investment Committee, two External Experts, and our Kristal Private Markets team of 10+ professionals.

Themes:

1. Tech Diffusion: With advanced tech enablement, an increased shift towards automation is seen across the globe and the industry spectrum. The fund aims to target companies that leverage advanced technology and thrive on its growing need.

2. Covid Rewiring: Some industry practices have changed significantly in the post covid era, creating blue ocean opportunities for innovative tech start-ups in certain industries. The fund focuses on companies that have sustained covid impact and emerged successful, and those that have capitalized on the opportunities covid has brought forth.

3. Sustainable Living: Favorable policy measures and mass adoption has boosted industries ranging from eco-friendly mobility, and wellness to sustainable eating. Investments in such disruptors are likely to benefit strongly from positive consumer preferences and favorable government regulations.

4.2. Why should you choose Kristal's Pre-IPO Fund?

Intrigued to know more about our Pre-IPO Fund offering? Click below: